Trusted by leading Brands for effective Coi management solutions

Customer Testimonial

Hey, I'm Bridgette!

Prior to SimpleCerts, COI management was manual and extremely time-consuming. After we started using SimpleCerts to organize thousands of local contractor insurance certificates in our platform, our compliance team saved hundreds of hours in a year, we reduced our risk, and created a simpler experience for our local contractors. I would highly recommend SimpleCerts for companies that want to improve the COI management process, reduce risk, and save money.

-Bridgette Lemke, Vice President | Operations & Compliance

We saved time

We saved money

We reduced risk

What our COI Tracker Includes

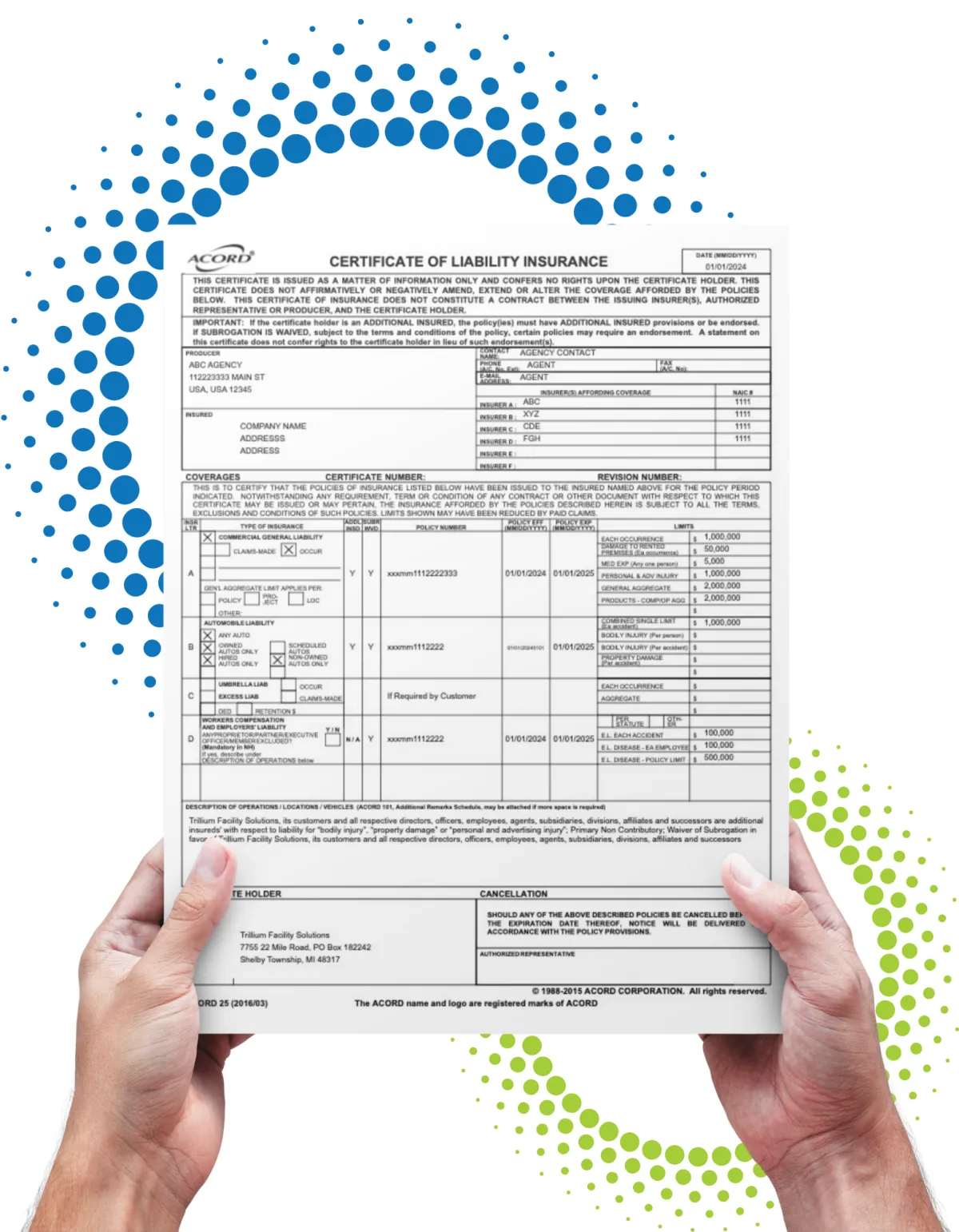

Complete certificate of insurance management that combines cutting-edge AI technology with expert human verification. SimpleCerts delivers affordable, fully managed COI tracking that eliminates compliance headaches for property managers, contractors, and risk professionals.

Fully managed COI Software Solution

Automated certificate collection, compliance tracking, and renewal management. Upload your requirements once and let our platform handle vendor onboarding, document verification, and ongoing monitoring. Real-time dashboards keep you informed without the manual work.

Most Affordable COI Solution

Enterprise-grade certificate of insurance software at small business prices. No hidden fees, setup costs, or per-user charges. Get unlimited policyholder certificates, automated compliance alerts, and dedicated support starting at industry-leading rates.

Human COI Verification Included

When compliance issues arise or certificates need follow-up, our certified risk management professionals step in to handle vendor communication and resolution. You get AI-powered efficiency with human expertise managing the complex situations that require personal attention.

Industries Rely on SimpleCerts COI Tracking

From construction and property management to healthcare and manufacturing, businesses across every industry trust SimpleCerts for seamless certificate of insurance management. Discover how our automated COI tracking solutions protect companies like yours from compliance risks while streamlining vendor management processes.

Recent Blogs & Articles

5 Best Certificate of Insurance Tracking Software Tools in 2025

5 Best Certificate of Insurance Tracking Software Tools in 2025

Managing Certificates of Insurance (COIs) doesn't have to be overwhelming. Tracking insurance documents becomes easier with the right tools.

For contractors or risk managers handling vendors, software solutions can simplify compliance tasks. Spreadsheets and manual follow-ups just don't cut it anymore in 2025.

This guide explores the best certificate of insurance tracking software, helping you minimize risks and save time.

Best Features to Look for in Insurance Tracking Software

Choosing the right insurance tracking software is vital for maintaining compliance, mitigating risks, and saving time. Below are the key features to look for when evaluating your options:

Automated COI Tracking and Expiration Alerts

Manually tracking expiration dates is difficult for any business. Automated COI tracking solves this problem by sending early notifications before certificates expire.

This gives businesses enough time to process renewals and prevent compliance gaps. Real-time alerts help ensure deadlines aren't missed. They also cut down on the constant follow-ups that burden administrative teams.

Customizable Insurance Compliance Requirements

Different industries and contracts often have specific insurance requirements. Many companies require vendors to submit ACORD forms.

ACORD 25 provides proof of liability insurance commonly used by employers, while ACORD 28 provides evidence of property insurance.

Customizable settings allow you to filter only the policy types and insurance coverage that your industry needs.

Integration Capabilities

Seamless integration with ERP systems, project management tools, and accounting software improves efficiency. The best insurance tracking software syncs data across platforms without issues.

This ensures teams always have accurate and up-to-date information. It also prevents duplicate work and reduces manual errors. Most importantly, it keeps insurance compliance a responsibility shared by all departments.

AI-Powered Verification

Manually reviewing COIs takes time and often leads to errors. AI-driven verification tools solve this by automatically checking for mistakes and missing information.

They detect issues like incorrect policy dates, missing endorsements for additional insureds, or low coverage amounts. These tools work faster and often provide more accurate results than manual checks.

Vendor Engagement Tools

Managing vendor relationships plays a key role in the COI management process. Dedicated vendor portals simplify the submission process.

Automated reminders and status updates improve communication and reduce delays. These tools streamline collecting, reviewing, and approving insurance documents.

Best Certificate of Insurance Tracking Software in 2025

Selecting the appropriate COI tracking software is crucial for effective compliance management and risk mitigation. Below is a detailed comparison of five leading solutions:

1. SimpleCerts

Designed for businesses across multiple industries, SimpleCerts simplifies insurance compliance management by reducing manual tasks and ensuring compliant insurance coverage by using advanced machine learning and AI.

Key features:

Reduced administrative burden: Automates the collection, verification, and tracking of COIs, minimizing manual work and reducing errors, allowing insurance professionals to focus on strategic tasks.

Real-time updates: Provides instant alerts for compliance issues or automated renewal requests, allowing businesses to act proactively and effectively track certificates.

Vendor-friendly interface: Offers an easy-to-navigate portal for vendors to upload certificates quickly and efficiently, improving insurance tracking services.

Robust reporting and analytics: Delivers detailed insights and compliance metrics to help businesses monitor performance and address insurance risk effectively.

SimpleCerts is ideal for medium to large businesses that require a reliable and scalable COI tracking solution. Industries such as construction, real estate, retail, health, and manufacturing benefit significantly from its features.

Click here to get your instant COI management software quote

2. myCOI

myCOI is a cloud-based platform for organizations seeking a comprehensive COI tracking solution and willing to invest in training and resources to fully utilize the platform's capabilities.

Its features and support make it suitable for industries with complex compliance requirements.

Features:

Advanced analytics: myCOI provides in-depth insights into compliance data, enabling organizations to make informed decisions regarding risk management and insurance compliance.

Strong customer support: The platform offers a responsive support team to assist with implementation and other concerns.

Cons:

Steep learning curve: New users may require significant time to become proficient with the platform due to its comprehensive feature set and complexity.

Limited customization: While robust, the platform's workflows may not fully align with the unique needs of every organization, limiting flexibility for highly specialized requirements.

Click here to get your instant COI management software quote

3. CertFocus

CertFocus is a COI and document management solution tailored for large organizations, including Fortune 500 companies and public sector entities. The platform specializes in industries with stringent compliance requirements.

Features:

Automated compliance management: CertFocus automates the identification and resolution of compliance issues, reducing manual intervention and ensuring higher compliance rates.

Flexible service levels: Offering a range of service options from self-service to full-service models, CertFocus caters to varying organizational needs.

Dedicated account managers: With a focus on excellent customer support they provided guidance from experts with industry-specific certifications (CIC, CPCU, CISR, CRIS) for personalized support.

Cons:

Outdated interface: The platform's user interface may feel outdated compared to more modern solutions, which can impact usability for some users.

Training necessity: Due to its comprehensive feature set, users might need extensive training to fully leverage the platform's capabilities, which could entail additional time and investment.

Click here to get your instant COI management software quote

4. Jones

Jones streamlines compliance for property management and construction companies. It offers COI tracking software, tracks regulatory compliance, and optimizes insurance management.

Features:

Integration options: Offers excellent compatibility with various platforms such as Procore and MRI Software, enhancing operational efficiency.

Compliance at scale: Jones caters to large-scale operations, helping property managers oversee multiple vendors and projects simultaneously.

Cons:

Limited advanced analytics: This may lack some of the in-depth analytical tools offered by competitors, potentially limiting data-driven decision-making.

Niche focus: Jones is primarily tailored for property management and construction industries, which may make it less suitable for businesses outside these sectors.

Click here to get your instant COI management software quote

5. TrustLayer

TrustLayer is a collaborative risk management platform that automates the verification of COIs and other compliance documents.

It uses artificial intelligence and machine learning to simplify the COI tracking processes, reduce manual errors, and enhance operational efficiency.

Features:

AI-powered automation: TrustLayer employs advanced AI and machine learning technologies to automate the verification of compliance documents, minimizing manual intervention and errors.

Collaboration features: The platform facilitates efficient communication and document sharing without requiring vendors to sign in, enhancing user experience and transparency.

Cons:

Developing feature set: As a relatively newer entrant in the market, TrustLayer's feature set is lacking.

Evolving integration options: Currently, its integration options are limited compared to other solutions, which could affect seamless connectivity with certain existing systems.

Click here to get your instant COI management software quote

How to Choose the Best Certificate of Insurance Tracking Software

Finding the right COI tracking software requires careful consideration of your organization's specific needs and goals. Below are key factors to help you make an informed decision.

Assessing Needs

Before exploring software options, assess the number of vendors you work with and the volume of COIs you manage. Businesses with high vendor turnover or large-scale operations often require advanced automation and reporting tools.

Smaller organizations, on the other hand, might benefit from simpler, more cost-effective solutions.

Comparing Features

Evaluate features that match your compliance needs carefully. Look for automation to handle repetitive tasks efficiently.

A user-friendly interface makes the software easier to use for everyone. Customizable compliance settings are crucial for meeting industry-specific requirements.

Tools with real-time notifications, detailed reporting, and system integration can greatly improve efficiency.

Budget Considerations

Determine your budget while keeping in mind the balance between cost and value. Avoid opting for overly complex systems that might exceed your needs or budget.

Focus on tools that deliver the essential features your business requires without unnecessary expenses.

Seeking Reviews and Testimonials

Look for feedback on the software's reliability, customer support, and ease of implementation. Peer reviews often highlight strengths and potential limitations you might not notice at first glance.

Testing Software

Take advantage of free trials or demos to test the software's functionality and usability. Pay attention to how well it integrates into your existing workflows and whether it simplifies compliance management.

This hands-on experience is invaluable for making the right choice.

Automate Insurance Tracking With SimpleCerts

Improve your risk management process with SimpleCerts, one of the best certificate of insurance tracking software options available. Manual tracking is slow and error-prone, leaving businesses open to coverage lapses.

With SimpleCerts, you can automate renewal reminders, have real-time compliance tracking, and use advanced AI to automatically spot any inconsistencies.

Get your instant quote to make sure your business is covered and safe from any unwanted liabilities.

Frequently Asked Questions

What is COI software?

COI software automates the management, verification, and tracking of Certificates of Insurance to ensure compliance and reduce manual errors.

What good is a certificate of insurance?

A certificate of insurance provides proof of coverage, verifying that vendors, contractors, or partners meet insurance requirements and protecting businesses from liability risks.

What is COI tracking?

COI tracking is the process of monitoring Certificates of Insurance for compliance, expiration dates, and coverage details to ensure vendors and partners meet contractual obligations.

What organization publishes certificates of insurance?

Certificates of Insurance are typically issued by insurance providers or brokers, following standardized formats like ACORD forms.

Related Articles:

Categories: COI Management, Software Comparison, Insurance Compliance

Tags: SimpleCerts, myCOI, CertFocus, Jones, TrustLayer, COI software comparison

Frequently Asked Questions

What is COI management software?

COI management software is a digital platform that automates the collection, tracking, and verification of certificates of insurance from vendors, contractors, and suppliers. SimpleCerts streamlines this process by automatically checking uploaded insurance documents against your company's specific requirements, highlighting discrepancies, and sending automated renewal reminders when certificates are about to expire.

How much does COI tracking software cost?

COI tracking software costs vary based on features, scale, and providers, with prices ranging from a few hundred to several thousand dollars annually. SimpleCerts offers the most affordable solution in the industry with transparent pricing that includes unlimited vendor certificates, automated compliance monitoring, and human oversight - all without hidden fees or per-user charges.

What is the difference between a COI and an insurance policy?

While not an insurance policy, a certificate of insurance (COI) contains essential details proving one was issued and exists. These single-page forms include the policyholder's name, effective and expiration date, type of coverage, additional insured and waiver of subrogation, and policy limits. SimpleCerts automatically extracts and verifies all this critical information from uploaded certificates.

How long should I keep certificates of insurance on file?

In a perfect world, a COI should be kept forever because a claim can arise anywhere down the line. The amount of time you keep a certificate on file depends on the nature of your organization and where you are located, but in general, certificates should be retained for a minimum of five years. SimpleCerts provides secure, unlimited cloud storage for all your certificates with easy search and retrieval.

Can vendors upload their own certificates?

Yes! SimpleCerts provides a user-friendly portal where vendors can directly upload their certificates of insurance. Both the producer and the insured can submit their documents. A lot of times we see the producer will submit something then the insured will go in and submit more information. Our system automatically processes and verifies each submission against your requirements.

What happens if a vendor's insurance doesn't meet our requirements?

SimpleCerts automatically identifies compliance deficiencies and sends customizable notifications to vendors explaining exactly what coverage is missing or inadequate. Our human oversight team can follow up with vendors to resolve complex compliance issues, ensuring you maintain 100% compliant coverage across your vendor network.

Does SimpleCerts integrate with existing business systems?

Yes, SimpleCerts is designed to integrate seamlessly with popular accounting, procurement, and project management systems. Our API allows for smooth data flow between platforms, ensuring your COI compliance data is accessible where you need it most.

How accurate is automated COI processing?

While there is no perfect OCR (optical character recognition) technology, our software migrates 98% of the data from an insurance certificate during the migration process. SimpleCerts combines AI-powered document processing with human expert verification to ensure maximum accuracy while maintaining fast processing speeds.

What industries benefit most from COI tracking software?

Nearly every industry is required to be compliant with insurance. From the retail store where you buy your shirts to the transportation company that delivers those shirts, everyone needs to ensure compliance with COIs. SimpleCerts serves property managers, general contractors, facility managers, risk managers, and any business working with third-party vendors or suppliers.

How quickly can SimpleCerts be implemented?

SimpleCerts is a cloud-based solution requiring no software installation. Most organizations can be up and running within days. Our team provides migration assistance to transfer your existing certificates and requirements into the system, plus comprehensive training to ensure your team can immediately start benefiting from automated COI management.