Trusted by leading Brands for effective Coi management solutions

Customer Testimonial

Hey, I'm Bridgette!

Prior to SimpleCerts, COI management was manual and extremely time-consuming. After we started using SimpleCerts to organize thousands of local contractor insurance certificates in our platform, our compliance team saved hundreds of hours in a year, we reduced our risk, and created a simpler experience for our local contractors. I would highly recommend SimpleCerts for companies that want to improve the COI management process, reduce risk, and save money.

-Bridgette Lemke, Vice President | Operations & Compliance

We saved time

We saved money

We reduced risk

What our COI Tracker Includes

Complete certificate of insurance management that combines cutting-edge AI technology with expert human verification. SimpleCerts delivers affordable, fully managed COI tracking that eliminates compliance headaches for property managers, contractors, and risk professionals.

Fully managed COI Software Solution

Automated certificate collection, compliance tracking, and renewal management. Upload your requirements once and let our platform handle vendor onboarding, document verification, and ongoing monitoring. Real-time dashboards keep you informed without the manual work.

Most Affordable COI Solution

Enterprise-grade certificate of insurance software at small business prices. No hidden fees, setup costs, or per-user charges. Get unlimited policyholder certificates, automated compliance alerts, and dedicated support starting at industry-leading rates.

Human COI Verification Included

When compliance issues arise or certificates need follow-up, our certified risk management professionals step in to handle vendor communication and resolution. You get AI-powered efficiency with human expertise managing the complex situations that require personal attention.

Industries Rely on SimpleCerts COI Tracking

From construction and property management to healthcare and manufacturing, businesses across every industry trust SimpleCerts for seamless certificate of insurance management. Discover how our automated COI tracking solutions protect companies like yours from compliance risks while streamlining vendor management processes.

Recent Blogs & Articles

How to Start Tracking Certificates of Insurance (+Top 5 Platforms)

How to Start Tracking Certificates of Insurance (+Top 5 Platforms)

Have you ever wondered how businesses efficiently track and manage certificates of insurance? Managing COI documents can be particularly challenging when dealing with multiple vendors, contractors, and compliance requirements.

These certificates are integral to risk management and ensure you don't shoulder unnecessary liability when accidents or unfortunate incidents occur with third-party vendors.

In this comprehensive guide, we'll provide valuable tips on how to easily start tracking certificates of insurance and share the top platforms that automate this critical process.

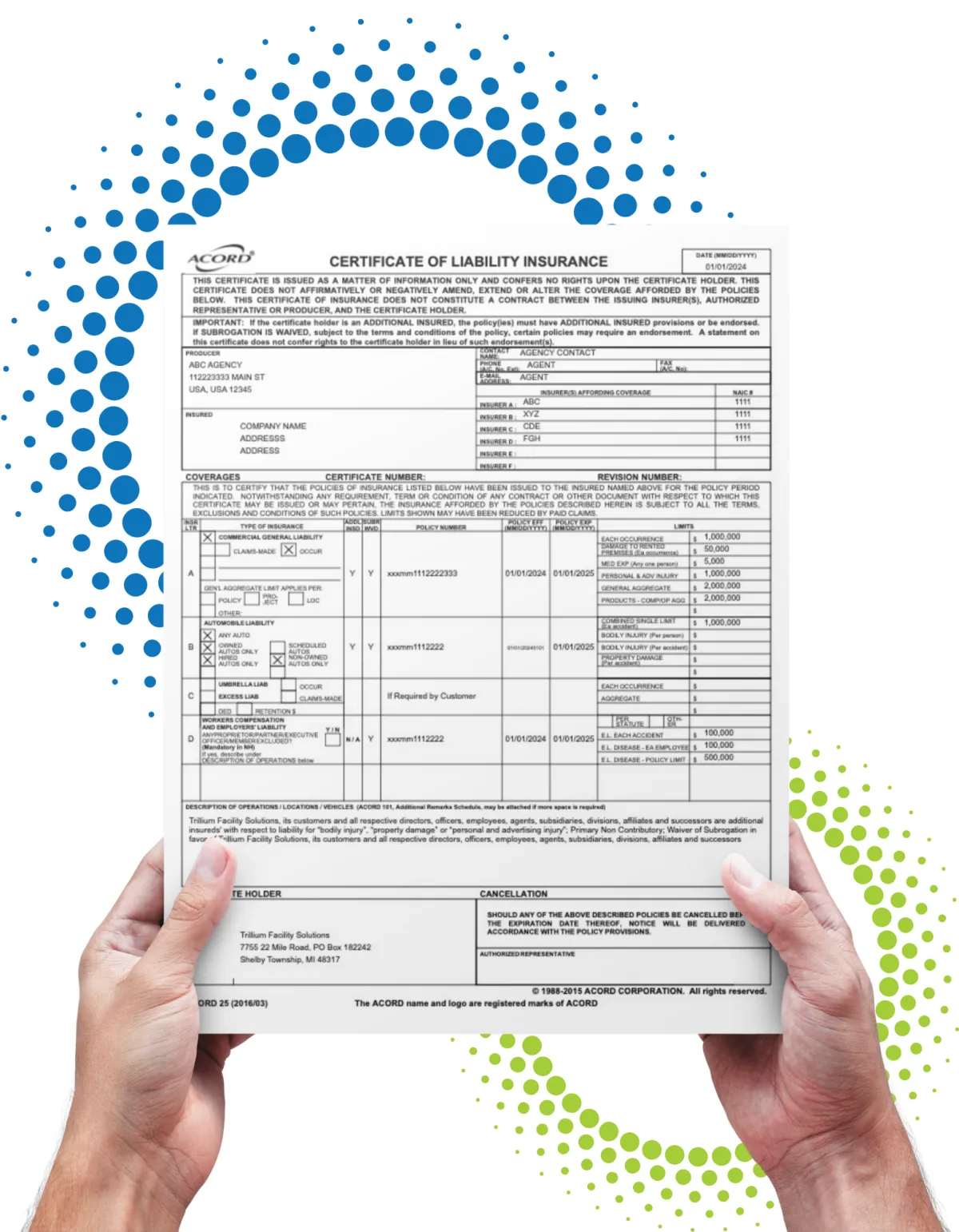

What Are Certificates of Insurance?

Certificates of Insurance are documents that confirm active insurance coverage for individuals or businesses. Issued by insurance providers, they summarize key policy details including coverage type, insured party, coverage limits, and effective dates.

Businesses use COIs to ensure vendors, contractors, and other third parties meet necessary insurance requirements, protecting against potential liabilities and financial risks. These certificates act as proof of protection, providing policyholders with financial safeguards against risks like property damage or injuries.

Proper COI tracking prevents issues like expired policies or insufficient coverage, reducing financial losses and compliance problems that could impact your business operations.

Who Regulates Insurance Compliance?

While COIs are not mandated by federal law, they are regulated at the state level with variations across jurisdictions. The Department of Financial Services states that Certificates of Insurance must not include terms or clauses not found in the actual insurance policy.

State regulations may differ on specific requirements. For example, adding unauthorized terms can alter the policy's scope and is prohibited under N.Y. Insurance Law 2307. Licensed producers cannot modify COIs to add extra terms without proper approval from insurance carriers.

Top 5 COI Tracking Software Solutions

Tracking certificates of insurance manually can be overwhelming and error-prone. Fortunately, modern COI tracking software simplifies this process significantly. Below, we'll review the top five COI tracking tools, highlighting their strengths and key features.

1. SimpleCerts - AI-Powered COI Management

SimpleCerts is an advanced AI-powered COI tracking tool designed to streamline vendor management and insurance compliance. Its intelligent features reduce administrative workloads while improving compliance accuracy, helping insurance professionals stay organized and compliant.

Key Features:

Automated Certificate Processing: Users can easily upload certificates through an intuitive interface with AI-powered verification

Real-Time Compliance Monitoring: Continuously checks uploaded COIs against your defined requirements, flagging discrepancies instantly

Customizable Insurance Requirements: Set and adjust coverage thresholds based on industry, region, or contract-specific needs

Centralized Dashboard: Single interface to view, track, and manage all COIs across your entire vendor portfolio

Automated Alerts & Reminders: Receive timely notifications about expiring certificates and upcoming renewals

Best For: Organizations seeking a comprehensive, AI-powered solution that eliminates manual COI tracking while ensuring maximum compliance accuracy.

Learn more about SimpleCerts for property managers or risk management teams.

Click here to get your instant COI management software quote

2. myCOI - Enterprise-Focused Compliance

myCOI is a cloud-based platform designed for organizations with complex compliance requirements. It offers comprehensive features to help businesses manage COIs efficiently, though it may require training to use effectively.

Key Features:

Automated collection and tracking of COIs across multiple business units

Real-time compliance verification directly with insurance agents

Advanced analytics to assess compliance gaps and risk exposure

Centralized repository for storing and managing insurance documents

Best For: Large enterprises requiring detailed compliance tracking across multiple locations and business units.

Click here to get your instant COI management software quote

3. TrustLayer - Collaborative Risk Management

TrustLayer focuses on collaborative risk management, allowing businesses to work closely with vendors and insurance providers to ensure comprehensive compliance.

Key Features:

Real-time verification of COIs with insurance carriers

Integration capabilities with ERP and CRM systems

Customizable compliance rules tailored to specific business requirements

Collaborative tools for vendor and partner communication

Best For: Companies requiring tight integration with existing business systems and collaborative vendor management.

Click here to get your instant COI management software quote

4. Jones - Industry-Specific Solutions

Jones specializes in COI tracking for construction and real estate industries, providing focused solutions for managing vendor compliance in these sectors.

Key Features:

Automated collection, verification, and renewal tracking

Integration with industry tools like Procore and MRI Software

Predictive analytics to assess vendor compliance risks

Access to verified insurance data networks

Best For: Construction and real estate companies requiring industry-specific compliance management.

Click here to get your instant COI management software quote

5. SmartCompliance - SMB-Focused Platform

SmartCompliance provides an intuitive platform for managing COIs and automating renewals, designed primarily for small and mid-sized businesses.

Key Features:

Optical Character Recognition (OCR) for digitizing paper documents

Real-time alerts for upcoming expirations and compliance updates

Customizable dashboards for tracking compliance metrics

Comprehensive reporting tools for audit preparation

Best For: Small to medium-sized businesses seeking flexible COI management without complexity.

Click here to get your instant COI management software quote

Benefits of Using COI Tracking Software

Reduced Risk and Liability

Without proper verification, businesses face significant liabilities for accidents or damages caused by uninsured third parties. Automated certificate tracking simplifies monitoring and helps avoid costly penalties.

Advanced platforms like SimpleCerts use AI models to detect coverage gaps or expiring policies early, allowing you to address insurance risks before they become problems.

Increased Efficiency and Productivity

Modern COI software allows vendors and contractors to submit certificates through user-friendly portals. The system then compiles and validates documents against your compliance standards automatically.

Customizable compliance criteria enable businesses to set specific requirements based on risk profiles or industry needs, such as those required in construction or property management operations.

All COIs and compliance records are securely stored in the cloud, providing 24/7 access from anywhere - particularly beneficial for businesses with decentralized teams or multiple locations.

Tips and Strategies for Effective COI Tracking

Implement Comprehensive Insurance Tracking Software

Start by reviewing your current compliance requirements and pain points. Choose a software solution like SimpleCerts that offers automation, real-time monitoring, and customizable features that match your specific needs.

Train your team to use the system effectively and provide vendors with clear instructions for submitting COIs and insurance documentation.

Define Clear Compliance Standards

Establish clear compliance standards to set expectations and minimize compliance issues. These standards should define required insurance types, minimum coverage limits, and policy durations specific to your industry and risk profile.

For example, construction companies might require $1 million in general liability coverage and continuous workers' compensation insurance for all subcontractors.

Communicating these requirements upfront makes it easier for vendors to meet expectations without delays or confusion.

Automate Certificate Collection

Modern COI tracking software simplifies collection by allowing users to upload certificates directly through user-friendly portals. These documents are then verified and cross-checked using AI to ensure they meet your specific coverage requirements.

Monitor Expiration Dates and Renewals Proactively

Automated reminders notify both businesses and vendors when COIs are approaching expiration dates. This gives contractors adequate time to submit updated documents and maintain continuous compliance.

Timely renewals are especially important in construction, property management, and other businesses where insurance needs may change with project timelines and seasonal variations.

Conduct Regular Reviews and Updates

Insurance policies can change, and outdated COIs may not meet current compliance standards. Regular audits help identify gaps like expired documents or insufficient coverage levels.

Addressing these issues quickly helps your organization build trust with stakeholders and ensures smooth insurance compliance management across all vendor relationships.

Streamline Your COI Tracking With SimpleCerts

Manual COI tracking presents significant challenges for busy teams managing multiple vendors and compliance requirements. SimpleCerts stands out with its cost-effective solution that leverages advanced AI models for speed and accuracy.

Unlike other platforms, SimpleCerts eliminates labor-intensive processes while providing unlimited user access with no extra charges - perfect for growing teams and expanding operations.

The platform's intuitive navigation makes it easy to implement quickly, while API integration capabilities connect seamlessly with your existing systems to help mitigate risks before they occur.

Ready to transform your COI tracking process? Click here to get your instant COI management software quote today and see how SimpleCerts can streamline your certificate of insurance management.

For role-specific solutions, explore our pages for facility managers, contract administrators, and accounts payable teams.

Frequently Asked Questions About COI Tracking

What is COI tracking? COI tracking is the systematic process of managing and monitoring Certificates of Insurance to ensure vendors and third parties maintain active, adequate insurance coverage that meets your specific requirements.

How do you verify a certificate of insurance is valid? To verify a COI, check policy details including coverage limits, effective dates, and policyholder information. Confirm authenticity by contacting the issuing insurance company directly or using automated verification tools.

How do you keep track of insurance policies effectively? Use specialized insurance tracking software to centralize COI records, automate renewal reminders, and monitor compliance statuses in real-time. Digital tools eliminate manual errors and simplify organization.

How do you find a certificate of insurance? Request COIs directly from vendors or their insurance providers. Many organizations include COI submission as part of their standard vendor onboarding process to ensure compliance from the start.

What happens if a vendor's insurance expires? When vendor insurance expires, you may be exposed to liability for accidents or damages. Automated tracking systems send alerts before expiration, allowing you to request renewals and maintain continuous coverage.

How often should COI tracking be reviewed? Review COI tracking processes quarterly at minimum, with monthly reviews recommended for high-risk industries. Automated systems provide continuous monitoring, but regular audits ensure compliance standards remain current.

Categories: COI Management, Insurance Compliance, Software Comparison Tags: SimpleCerts, myCOI, TrustLayer, Jones, SmartCompliance, COI tracking comparison, insurance verification, compliance management

Frequently Asked Questions

What is COI management software?

COI management software is a digital platform that automates the collection, tracking, and verification of certificates of insurance from vendors, contractors, and suppliers. SimpleCerts streamlines this process by automatically checking uploaded insurance documents against your company's specific requirements, highlighting discrepancies, and sending automated renewal reminders when certificates are about to expire.

How much does COI tracking software cost?

COI tracking software costs vary based on features, scale, and providers, with prices ranging from a few hundred to several thousand dollars annually. SimpleCerts offers the most affordable solution in the industry with transparent pricing that includes unlimited vendor certificates, automated compliance monitoring, and human oversight - all without hidden fees or per-user charges.

What is the difference between a COI and an insurance policy?

While not an insurance policy, a certificate of insurance (COI) contains essential details proving one was issued and exists. These single-page forms include the policyholder's name, effective and expiration date, type of coverage, additional insured and waiver of subrogation, and policy limits. SimpleCerts automatically extracts and verifies all this critical information from uploaded certificates.

How long should I keep certificates of insurance on file?

In a perfect world, a COI should be kept forever because a claim can arise anywhere down the line. The amount of time you keep a certificate on file depends on the nature of your organization and where you are located, but in general, certificates should be retained for a minimum of five years. SimpleCerts provides secure, unlimited cloud storage for all your certificates with easy search and retrieval.

Can vendors upload their own certificates?

Yes! SimpleCerts provides a user-friendly portal where vendors can directly upload their certificates of insurance. Both the producer and the insured can submit their documents. A lot of times we see the producer will submit something then the insured will go in and submit more information. Our system automatically processes and verifies each submission against your requirements.

What happens if a vendor's insurance doesn't meet our requirements?

SimpleCerts automatically identifies compliance deficiencies and sends customizable notifications to vendors explaining exactly what coverage is missing or inadequate. Our human oversight team can follow up with vendors to resolve complex compliance issues, ensuring you maintain 100% compliant coverage across your vendor network.

Does SimpleCerts integrate with existing business systems?

Yes, SimpleCerts is designed to integrate seamlessly with popular accounting, procurement, and project management systems. Our API allows for smooth data flow between platforms, ensuring your COI compliance data is accessible where you need it most.

How accurate is automated COI processing?

While there is no perfect OCR (optical character recognition) technology, our software migrates 98% of the data from an insurance certificate during the migration process. SimpleCerts combines AI-powered document processing with human expert verification to ensure maximum accuracy while maintaining fast processing speeds.

What industries benefit most from COI tracking software?

Nearly every industry is required to be compliant with insurance. From the retail store where you buy your shirts to the transportation company that delivers those shirts, everyone needs to ensure compliance with COIs. SimpleCerts serves property managers, general contractors, facility managers, risk managers, and any business working with third-party vendors or suppliers.

How quickly can SimpleCerts be implemented?

SimpleCerts is a cloud-based solution requiring no software installation. Most organizations can be up and running within days. Our team provides migration assistance to transfer your existing certificates and requirements into the system, plus comprehensive training to ensure your team can immediately start benefiting from automated COI management.