Trusted by leading Brands for effective Coi management solutions

Customer Testimonial

Hey, I'm Bridgette!

Prior to SimpleCerts, COI management was manual and extremely time-consuming. After we started using SimpleCerts to organize thousands of local contractor insurance certificates in our platform, our compliance team saved hundreds of hours in a year, we reduced our risk, and created a simpler experience for our local contractors. I would highly recommend SimpleCerts for companies that want to improve the COI management process, reduce risk, and save money.

-Bridgette Lemke, Vice President | Operations & Compliance

We saved time

We saved money

We reduced risk

What our COI Tracker Includes

Complete certificate of insurance management that combines cutting-edge AI technology with expert human verification. SimpleCerts delivers affordable, fully managed COI tracking that eliminates compliance headaches for property managers, contractors, and risk professionals.

Fully managed COI Software Solution

Automated certificate collection, compliance tracking, and renewal management. Upload your requirements once and let our platform handle vendor onboarding, document verification, and ongoing monitoring. Real-time dashboards keep you informed without the manual work.

Most Affordable COI Solution

Enterprise-grade certificate of insurance software at small business prices. No hidden fees, setup costs, or per-user charges. Get unlimited policyholder certificates, automated compliance alerts, and dedicated support starting at industry-leading rates.

Human COI Verification Included

When compliance issues arise or certificates need follow-up, our certified risk management professionals step in to handle vendor communication and resolution. You get AI-powered efficiency with human expertise managing the complex situations that require personal attention.

Industries Rely on SimpleCerts COI Tracking

From construction and property management to healthcare and manufacturing, businesses across every industry trust SimpleCerts for seamless certificate of insurance management. Discover how our automated COI tracking solutions protect companies like yours from compliance risks while streamlining vendor management processes.

Recent Blogs & Articles

Contractor Insurance Management System: 5 Best Options in 2025

Contractor Insurance Management System: 5 Best Options in 2025

Managing contractor insurance documentation can feel overwhelming when you're coordinating multiple projects, vendors, and compliance requirements. Ensuring your Certificates of Insurance (COIs) stay current and compliant adds even more pressure to already demanding schedules.

With busy workloads and complex project timelines, most construction managers and contractors struggle to monitor insurance policies effectively, creating significant liability risks and potential project delays.

In this comprehensive guide, we'll explore how contractor insurance management systems simplify COI management and share the five best platforms available in 2025 to protect your business and streamline operations.

What Is a Contractor Insurance Management System?

A contractor insurance management system is specialized software that automates the entire insurance tracking process for construction projects and contractor relationships. These platforms enable contractors to submit their Certificates of Insurance quickly and efficiently through user-friendly digital portals.

The system automatically tracks all submitted certificates and verifies that each COI meets your specific compliance requirements, including coverage amounts, policy dates, and required endorsements. This automation eliminates the delays and repetitive manual processes associated with traditional COI collection and verification methods.

Advanced systems provide real-time notifications to keep businesses informed about compliance status, automatically requesting additional documentation when requirements aren't met, and alerting teams before policies expire.

Why Contractors Need Comprehensive Insurance Management

Financial Liability Protection

Without valid insurance coverage, general contractors become personally responsible for accidents, property damage, or injuries that occur on job sites. This liability exposure can result in devastating financial consequences that threaten business viability.

Project Continuity Assurance

Project delays frequently occur when contractor insurance lapses or fails to meet compliance standards established by property owners or regulatory requirements. These interruptions disrupt carefully planned schedules, increase costs, and damage professional relationships with clients and stakeholders.

Regulatory Compliance Requirements

Failing to maintain proper contractor insurance compliance can trigger regulatory penalties, including substantial fines and legal actions. Many jurisdictions require specific insurance verification before work permits are issued, making compliance management essential for project approval and completion.

Modern contractor insurance management systems address these critical challenges while reducing administrative burden on busy construction teams.

Top 5 Contractor Insurance Management Systems in 2025

Managing contractor insurance requires sophisticated tools that balance automation with accuracy. Here are the five leading contractor insurance management systems that deliver comprehensive solutions:

1. SimpleCerts - AI-Powered Intelligence for Construction

SimpleCerts leads the contractor insurance management space with cutting-edge AI technology designed specifically for construction professionals and general contractors. The platform combines advanced automation with human oversight to ensure maximum accuracy and compliance.

Key Features:

Intelligent Certificate Processing: Contractors upload COIs through an intuitive interface that supports multiple file formats. Advanced AI technology automatically extracts and verifies critical data, dramatically reducing processing time while minimizing human error.

Real-Time Compliance Monitoring: The system continuously monitors uploaded certificates against your predefined requirements, instantly flagging any discrepancies in coverage amounts, policy dates, or required endorsements.

Flexible Requirement Configuration: Businesses can establish and modify insurance coverage thresholds based on project types, contractor categories, and risk profiles specific to construction environments.

Unified Management Dashboard: A comprehensive, user-friendly interface allows construction managers to view, track, and manage all contractor COIs across multiple projects from a single location.

Unlimited User Access: Unlike competitors that charge per user, SimpleCerts provides unlimited access for growing construction teams without additional costs, making it ideal for expanding operations.

Seamless API Integration: Connect with existing construction management systems, project management tools, and accounting software to create streamlined workflows that reduce duplicate data entry.

Why SimpleCerts Excels: The platform's combination of AI accuracy, unlimited scalability, and construction-specific features makes it the preferred choice for contractors seeking reliable, efficient insurance management without hidden costs.

Click below to see how SimpleCerts transforms contractor insurance management.

Click here to get your instant COI management software quote

2. myCOI - Enterprise Compliance Focus

myCOI provides cloud-based solutions designed for organizations with complex, multi-location compliance needs. The platform offers comprehensive tools for collecting, tracking, and verifying COIs across large construction operations.

Key Features:

Advanced analytics capabilities for assessing compliance gaps and risk exposure

Real-time verification processes that confirm compliance directly with insurance agents

Comprehensive reporting tools that track compliance metrics for informed decision-making across multiple projects

Best For: Large construction enterprises requiring detailed compliance tracking across multiple geographic locations and complex organizational structures.

Click here to get your instant COI management software quote

3. TrustLayer - Collaborative Risk Management

TrustLayer operates as a collaborative risk management platform designed to automate COI verification while improving compliance workflows through enhanced communication tools.

Key Features:

Extensive integration capabilities that connect seamlessly with ERP and CRM systems for streamlined data management

Collaborative communication tools that enhance coordination between contractors, project managers, and insurance providers

Best For: Construction companies requiring advanced integration capabilities with existing business systems and emphasis on collaborative vendor management approaches.

Click here to get your instant COI management software quote

4. Jones - Construction Industry Specialist

Jones focuses specifically on contractor insurance management for construction and real estate sectors, providing industry-tailored solutions for managing vendor compliance in these specialized environments.

Key Features:

Automated COI management that handles collection, verification, and renewal tracking processes

Direct integration with construction-specific platforms like Procore and MRI Software for seamless workflow coordination

Best For: Construction and real estate companies seeking industry-specific solutions with established integrations to popular construction management platforms.

Click here to get your instant COI management software quote

5. SmartCompliance - Small Business Solutions

SmartCompliance delivers an intuitive platform designed for managing COIs and automating renewals, specifically tailored for small and mid-sized construction businesses with straightforward compliance needs.

Key Features:

Optical Character Recognition (OCR) technology that digitizes paper documents for streamlined compliance verification

Real-time alert system that notifies users of upcoming expirations and compliance updates

Best For: Small to medium-sized construction businesses seeking user-friendly COI management solutions without enterprise-level complexity or costs.

Click here to get your instant COI management software quote

Benefits of Modern Contractor Insurance Management Systems

Enhanced Vendor Relationships

Allowing contractors to upload COIs directly through self-service portals creates smoother collaboration and reduces friction in the onboarding process. Clear communication of compliance expectations builds trust between construction companies and their contractor networks while eliminating confusion about insurance requirements.

Significant Cost and Time Savings

Automating traditionally manual certificate management processes reduces administrative costs while freeing up valuable staff time for revenue-generating activities. AI-powered systems minimize costly errors that could lead to regulatory fines or project delays.

These platforms prevent expensive project interruptions caused by missing or invalid COIs, protecting construction schedules and budgets while maintaining positive client relationships.

Comprehensive Risk Mitigation

Uninsured contractors create serious financial and legal risks for construction companies. Modern management systems ensure all contractors maintain valid, adequate insurance coverage that meets project-specific requirements.

Centralized documentation storage makes critical insurance information easily accessible during audits, disputes, or emergency situations, while automated verification processes track and confirm the accuracy of all insurance documentation.

Implementation Guide: Getting Started with SimpleCerts

Implementing a contractor insurance management system like SimpleCerts can significantly improve your construction organization's efficiency in handling COI tracking and compliance. Here's a practical step-by-step implementation guide:

Step 1: Account Setup and Configuration

Visit the SimpleCerts website and click the "Get Started" button to begin the onboarding process. Provide your contact information, and a SimpleCerts specialist will guide you through account setup tailored to your construction business needs.

Step 2: Profile and Compliance Standards Configuration

Once your account is established, configure your company profile with essential business details including company name, address, and primary contacts. Most importantly, define your construction-specific insurance compliance standards.

Set requirements such as:

Minimum coverage amounts for general liability, workers' compensation, and professional liability

Required policy types for different contractor categories (electrical, plumbing, HVAC, etc.)

Essential endorsements like additional insured status and waiver of subrogation

Project-specific insurance requirements for high-risk or specialized work

Step 3: Contractor Onboarding and Certificate Submission

Provide your contractors with access to SimpleCerts' user-friendly upload interface. The platform accepts multiple file formats including PDF, JPEG, and other common document types, eliminating the need for file conversions that can delay submissions.

Contractors can log in independently and upload their insurance certificates quickly, reducing administrative burden on your team while ensuring faster project startup times.

Step 4: Automated Compliance Verification

After contractors upload their COIs, SimpleCerts automatically reviews each certificate against your predefined compliance requirements. The AI-powered system examines critical details including:

Coverage amounts and policy limits

Effective and expiration dates

Required endorsements and additional insured status

Carrier information and policy authenticity

You'll receive immediate notifications about compliance status, and the system automatically requests additional documentation from contractors when requirements aren't fully met.

Step 5: Dashboard Monitoring and Tracking

Use SimpleCerts' comprehensive dashboard to monitor compliance status across all active contractors and projects. The interface provides real-time updates on certificate compliance, approaching expiration dates, and any required follow-up actions.

Automated renewal reminders are sent to contractors before their policies expire, ensuring continuous coverage without manual intervention from your team.

Step 6: Reporting and Documentation

Generate detailed compliance reports for project stakeholders, insurance audits, or internal reviews. SimpleCerts allows you to customize reports by filtering data based on specific contractors, projects, time periods, or compliance criteria.

These reports provide comprehensive documentation of your proactive approach to contractor insurance management, supporting your risk mitigation efforts and regulatory compliance requirements.

Click here to get your instant COI management software quote

Industry-Specific Considerations for Construction

Project-Based Insurance Requirements

Different construction projects require varying insurance coverage levels and specialized endorsements. General contractors working on high-rise buildings need different coverage than those handling residential renovations or infrastructure projects.

Trade-Specific Coverage Needs

Electrical contractors, plumbing specialists, HVAC technicians, and other trades each require specific insurance coverage tailored to their unique risk profiles and regulatory requirements.

Seasonal and Weather-Related Considerations

Construction insurance requirements may vary based on seasonal factors, weather conditions, and geographic locations that affect project risk profiles and regulatory compliance needs.

Best Practices for Construction Insurance Management

Establish Clear Documentation Standards

Create comprehensive documentation requirements that specify exact insurance coverage types, minimum limits, and essential endorsements for different contractor categories and project types.

Implement Proactive Monitoring Systems

Use automated systems to track expiration dates and send renewal reminders well before coverage lapses, ensuring continuous protection throughout project lifecycles.

Regular Training and Updates

Keep project management staff updated on evolving insurance requirements, regulatory changes, and best practices for contractor compliance management.

Maintain Comprehensive Audit Trails

Document all insurance verification activities, communications with contractors, and compliance decisions to support your due diligence efforts and provide protection during disputes or regulatory reviews.

Transform Your Contractor Insurance Management Today

Manual contractor insurance management consumes valuable time while exposing construction companies to significant liability risks and potential project delays. SimpleCerts eliminates these challenges through intelligent automation that ensures accuracy while dramatically reducing administrative burden.

Our AI-powered platform provides unlimited user access, seamless integration capabilities, and continuous monitoring that keeps contractor compliance current across all your construction projects.

Ready to eliminate contractor insurance management headaches? Get a quote today and discover why construction professionals choose SimpleCerts for comprehensive contractor insurance management.

For industry-specific solutions, explore our specialized pages for general contractors, property management, and healthcare facilities.

Frequently Asked Questions About Contractor Insurance Management Systems

What is contractor management software? Contractor management software is a digital platform that helps construction companies manage contractor profiles, track compliance requirements, and store essential documents like contracts and Certificates of Insurance. It streamlines operations by automating verification tasks and compliance monitoring.

What is an insurance management system? An insurance management system is specialized software designed to track, store, and manage insurance policies including monitoring expiration dates, verifying compliance requirements, and automating renewal reminders. It ensures construction companies maintain accurate, up-to-date insurance documentation for all contractors.

What is construction insurance management? Construction insurance management refers to the systematic process of ensuring all contractors working on construction projects maintain adequate and compliant insurance coverage. This includes tracking COIs, verifying policy details, and confirming coverage meets project-specific requirements and regulatory standards.

What is a contractor system? A contractor system is a comprehensive software platform that centralizes all contractor-related activities including onboarding, compliance tracking, document management, and performance monitoring. It ensures contractor data and requirements are organized and accessible for efficient project management.

How does automated COI tracking help construction companies? Automated COI tracking reduces administrative burden, minimizes human error, ensures continuous compliance monitoring, and provides real-time alerts about expiration dates. This automation prevents project delays and reduces liability exposure while freeing up staff time for core construction activities.

What insurance types should construction companies require from contractors? Construction companies typically require general liability, workers' compensation, professional liability (if applicable), and commercial auto insurance. Additional coverage may include umbrella policies, builders risk, or specialized coverage based on contractor trade and project requirements.

How often should contractor insurance be reviewed? Contractor insurance should be verified before each new project begins and monitored continuously for expiration dates. Most construction companies conduct quarterly compliance reviews, with automated systems providing ongoing monitoring and alerts for policy changes or renewals.

Click here to get your instant COI management software quote

Categories: Contractor Management, Construction Insurance, COI Management

Tags: SimpleCerts, myCOI, TrustLayer, Jones, SmartCompliance, contractor insurance management, construction COI software, contractor compliance

Frequently Asked Questions

What is COI management software?

COI management software is a digital platform that automates the collection, tracking, and verification of certificates of insurance from vendors, contractors, and suppliers. SimpleCerts streamlines this process by automatically checking uploaded insurance documents against your company's specific requirements, highlighting discrepancies, and sending automated renewal reminders when certificates are about to expire.

How much does COI tracking software cost?

COI tracking software costs vary based on features, scale, and providers, with prices ranging from a few hundred to several thousand dollars annually. SimpleCerts offers the most affordable solution in the industry with transparent pricing that includes unlimited vendor certificates, automated compliance monitoring, and human oversight - all without hidden fees or per-user charges.

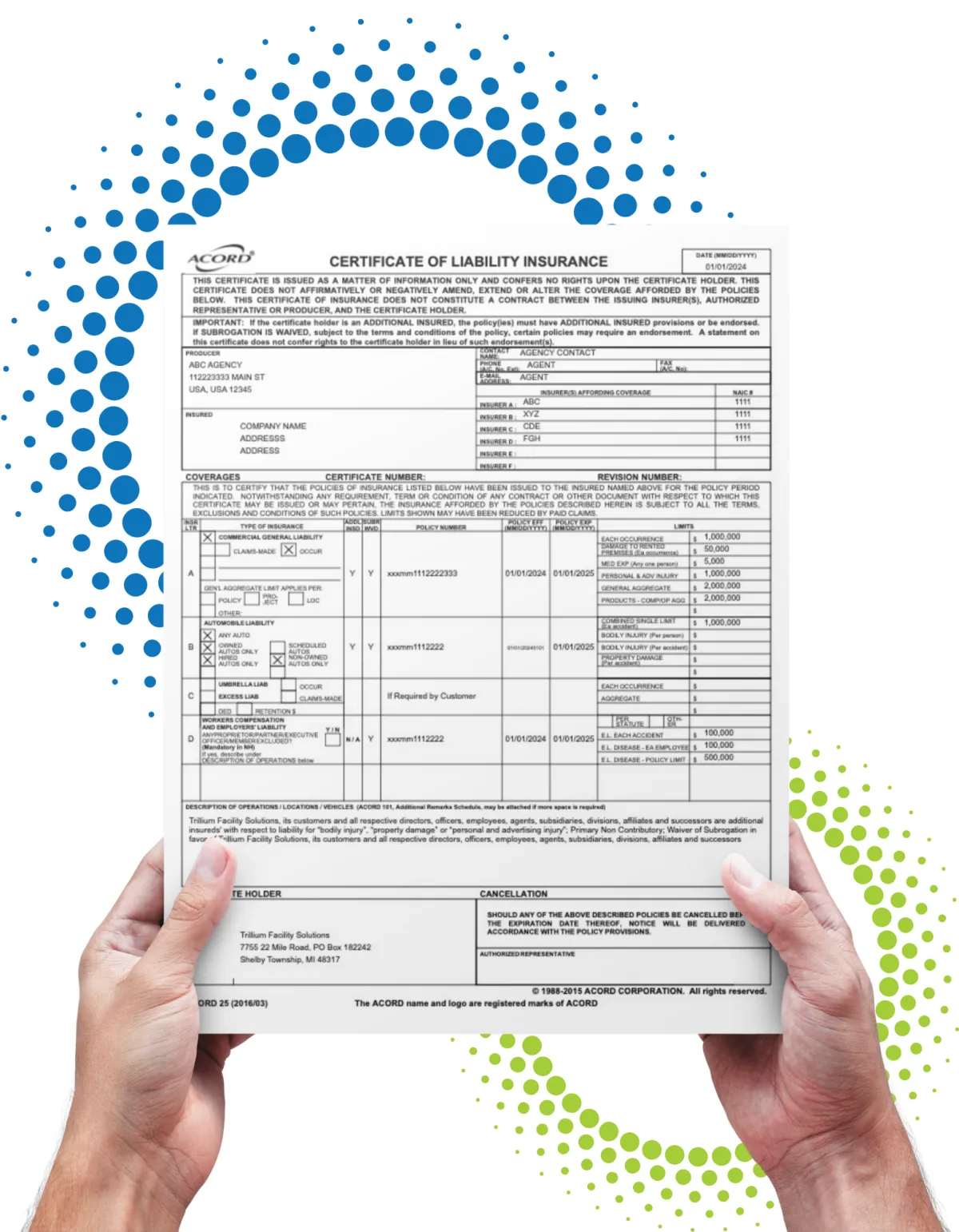

What is the difference between a COI and an insurance policy?

While not an insurance policy, a certificate of insurance (COI) contains essential details proving one was issued and exists. These single-page forms include the policyholder's name, effective and expiration date, type of coverage, additional insured and waiver of subrogation, and policy limits. SimpleCerts automatically extracts and verifies all this critical information from uploaded certificates.

How long should I keep certificates of insurance on file?

In a perfect world, a COI should be kept forever because a claim can arise anywhere down the line. The amount of time you keep a certificate on file depends on the nature of your organization and where you are located, but in general, certificates should be retained for a minimum of five years. SimpleCerts provides secure, unlimited cloud storage for all your certificates with easy search and retrieval.

Can vendors upload their own certificates?

Yes! SimpleCerts provides a user-friendly portal where vendors can directly upload their certificates of insurance. Both the producer and the insured can submit their documents. A lot of times we see the producer will submit something then the insured will go in and submit more information. Our system automatically processes and verifies each submission against your requirements.

What happens if a vendor's insurance doesn't meet our requirements?

SimpleCerts automatically identifies compliance deficiencies and sends customizable notifications to vendors explaining exactly what coverage is missing or inadequate. Our human oversight team can follow up with vendors to resolve complex compliance issues, ensuring you maintain 100% compliant coverage across your vendor network.

Does SimpleCerts integrate with existing business systems?

Yes, SimpleCerts is designed to integrate seamlessly with popular accounting, procurement, and project management systems. Our API allows for smooth data flow between platforms, ensuring your COI compliance data is accessible where you need it most.

How accurate is automated COI processing?

While there is no perfect OCR (optical character recognition) technology, our software migrates 98% of the data from an insurance certificate during the migration process. SimpleCerts combines AI-powered document processing with human expert verification to ensure maximum accuracy while maintaining fast processing speeds.

What industries benefit most from COI tracking software?

Nearly every industry is required to be compliant with insurance. From the retail store where you buy your shirts to the transportation company that delivers those shirts, everyone needs to ensure compliance with COIs. SimpleCerts serves property managers, general contractors, facility managers, risk managers, and any business working with third-party vendors or suppliers.

How quickly can SimpleCerts be implemented?

SimpleCerts is a cloud-based solution requiring no software installation. Most organizations can be up and running within days. Our team provides migration assistance to transfer your existing certificates and requirements into the system, plus comprehensive training to ensure your team can immediately start benefiting from automated COI management.